|

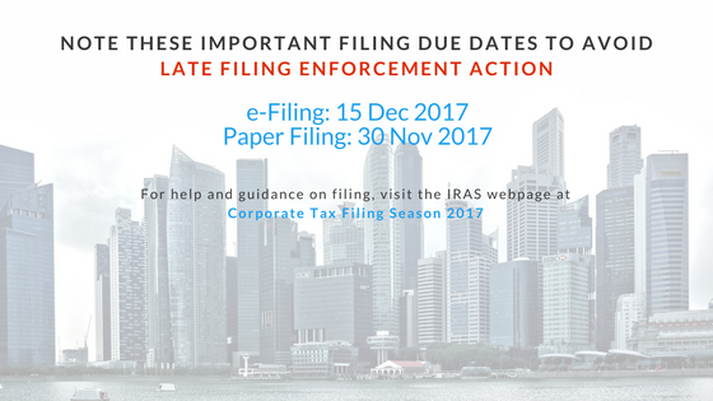

REMINDER: All companies, including those that had not carried out any business activities in the financial year or are in a loss position[1], must e-File their Corporate Income Tax Returns for YA 2017 by 15 Dec 2017, or 30 Nov 2017 if they paper file. Did you know that more companies can now use the Simplified Tax Return (Form C-S)? From YA2017, Singapore incorporated companies with annual revenue of not more than S$5 million can qualify to file Form C-S if they also meet these qualifying conditions. FYI, companies that file Form C-S do not need to submit their financial statements and tax computation. These documents should be retained and only submitted to IRAS upon request. Tax Saving Tips for Companies

For NEW Companies

>>50% tax exemption on the next $200,000 of chargeable income.

For assistance in filing your corporate tax, please feel free to contact us. Just fill out below form and we will get in touch with you. More info available here. [1] Excludes dormant companies that have been granted waiver of Income Tax Return submission.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Author

AstuitOne is a corporate service provider registered with the Accounting and Corporate Regulatory Authority (ACRA). We offer a range of services including CFO on-demand, accounting & payroll services, company secretarial, tax and business advisory. ArchivesCategories |

Company

|

|

RSS Feed

RSS Feed